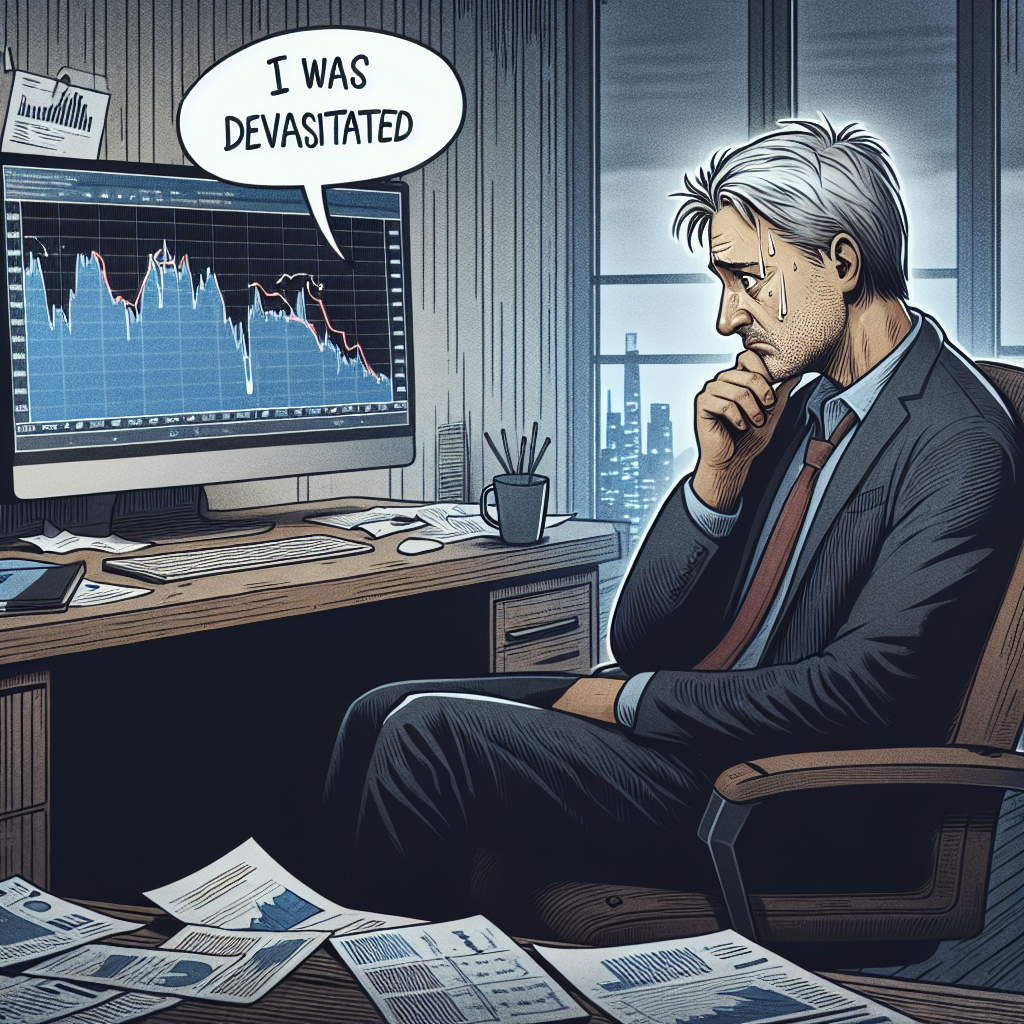

US Investor Faces $82,000 Stock Market Loss: “I Was Devastated”

US Investor Faces $82,000 Stock Market Loss: “I Was Devastated”

Introduction

An American investor recently experienced a significant financial setback, losing $82,000 in the stock market. This incident highlights the inherent risks of investing and serves as a cautionary tale for both novice and seasoned investors.

The Investor’s Experience

The investor, who wishes to remain anonymous, shared their emotional journey through this financial turmoil. The loss was not only a monetary blow but also an emotional one, leaving them feeling devastated and anxious about their financial future.

Key Factors Leading to the Loss

- Market Volatility: The stock market’s unpredictable nature played a significant role in the investor’s loss.

- Risky Investments: The investor had placed substantial funds in high-risk stocks, which did not perform as expected.

- Lack of Diversification: A concentrated investment portfolio increased vulnerability to market fluctuations.

Lessons Learned

Despite the financial setback, the investor has gained valuable insights from this experience:

- Importance of Diversification: Spreading investments across various sectors can mitigate risks.

- Understanding Market Trends: Staying informed about market conditions can help in making better investment decisions.

- Emotional Resilience: Maintaining composure during market downturns is crucial for long-term investment success.

Conclusion

This incident underscores the volatile nature of the stock market and the importance of strategic planning and emotional resilience in investing. While the loss was significant, the investor’s experience serves as a reminder of the lessons that can be learned from financial adversity.