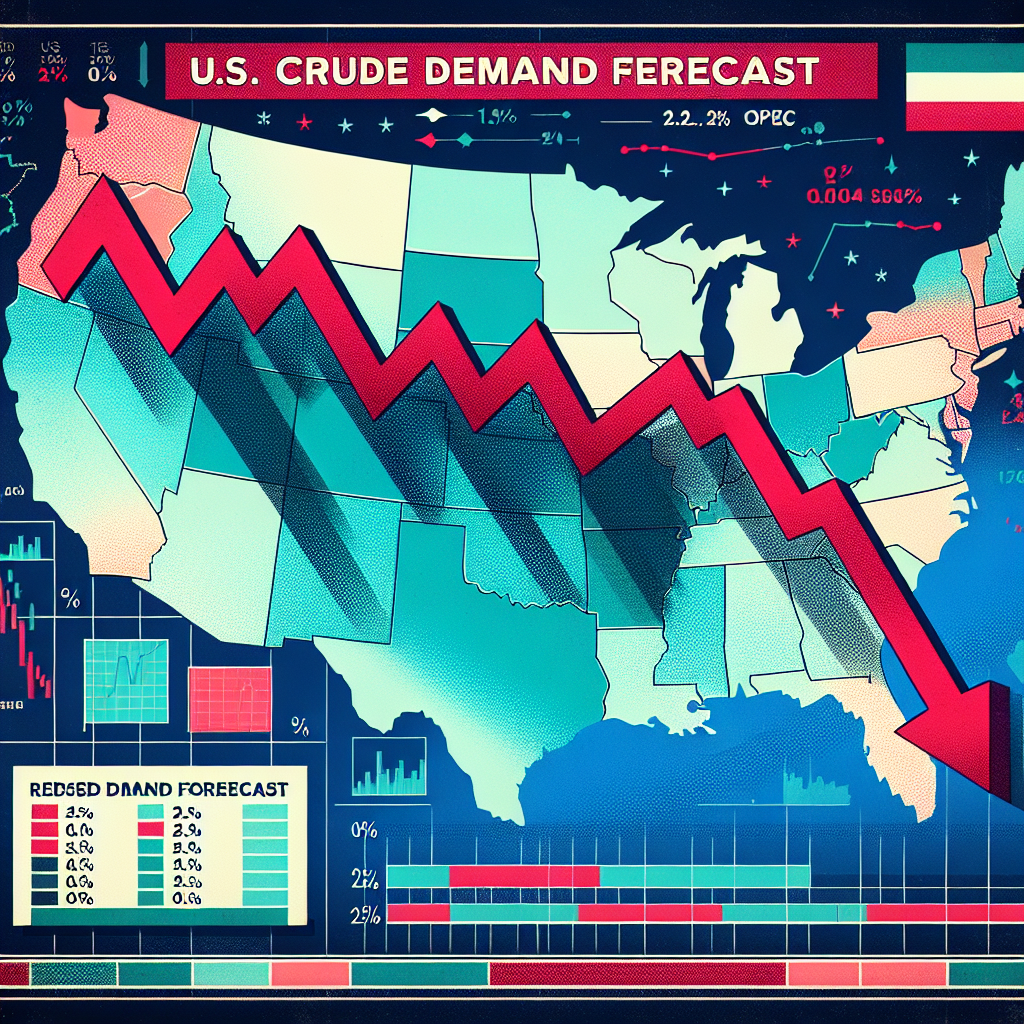

U.S. Crude Oil Prices Drop Over 2% Following OPEC’s Revised Demand Forecast

U.S. Crude Oil Prices Drop Over 2% Following OPEC’s Revised Demand Forecast

Overview

In a significant market shift, U.S. crude oil prices have fallen by more than 2% after the Organization of the Petroleum Exporting Countries (OPEC) released a revised demand forecast. This development has sparked discussions among investors and analysts about the future trajectory of oil prices and the broader implications for the global economy.

Key Factors Behind the Price Drop

- OPEC’s Revised Forecast: OPEC has adjusted its global oil demand forecast, citing slower-than-expected economic growth in key markets.

- Market Reaction: The revised forecast has led to a sell-off in oil futures, contributing to the price decline.

- Economic Concerns: Concerns over potential economic slowdowns in major economies have further pressured oil prices.

Implications for the Global Economy

The drop in oil prices could have several implications for the global economy, including:

- Consumer Impact: Lower oil prices may lead to reduced fuel costs for consumers, potentially boosting disposable income.

- Energy Sector Challenges: Energy companies may face financial pressures due to decreased revenue from lower oil prices.

- Inflationary Effects: A decline in oil prices could ease inflationary pressures, impacting central bank policies.

Market Outlook

Analysts are closely monitoring the situation to assess the long-term impact of OPEC’s revised demand forecast. The market’s response will depend on various factors, including geopolitical developments, economic data releases, and potential policy changes by major oil-producing countries.

Conclusion

The recent drop in U.S. crude oil prices, driven by OPEC’s revised demand forecast, highlights the volatility and interconnectedness of global energy markets. As stakeholders navigate this evolving landscape, the focus will remain on balancing supply and demand dynamics to ensure market stability.